Predetermined Overhead Rate

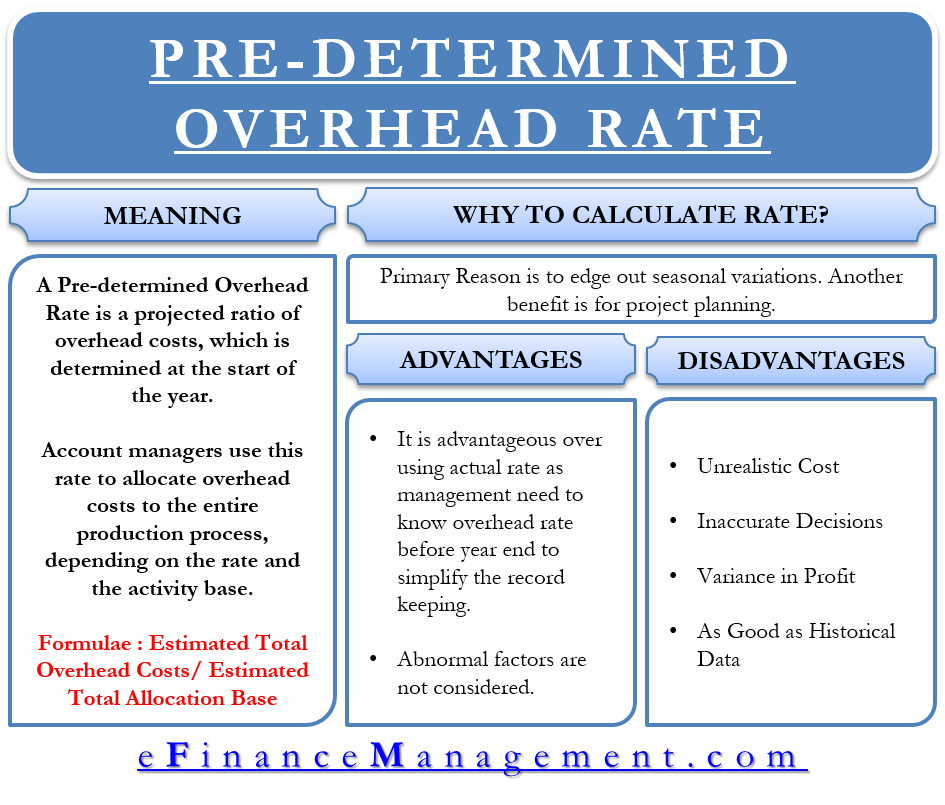

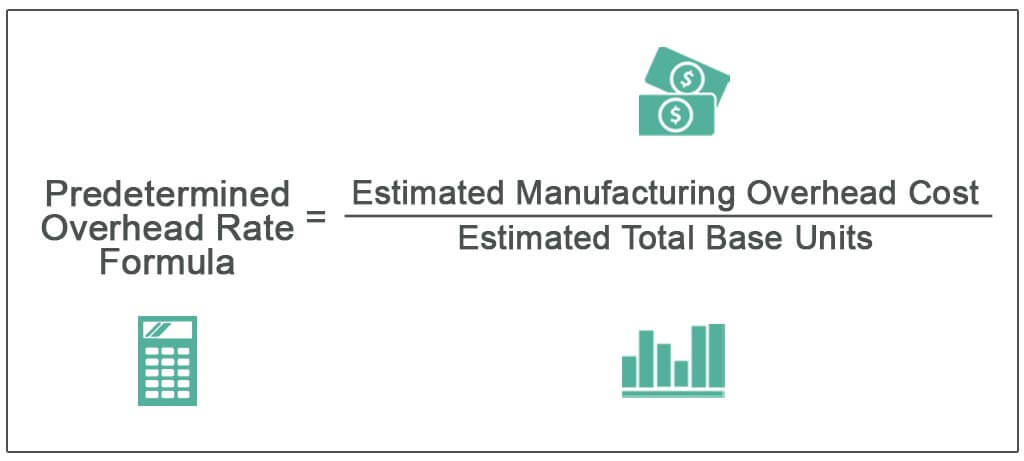

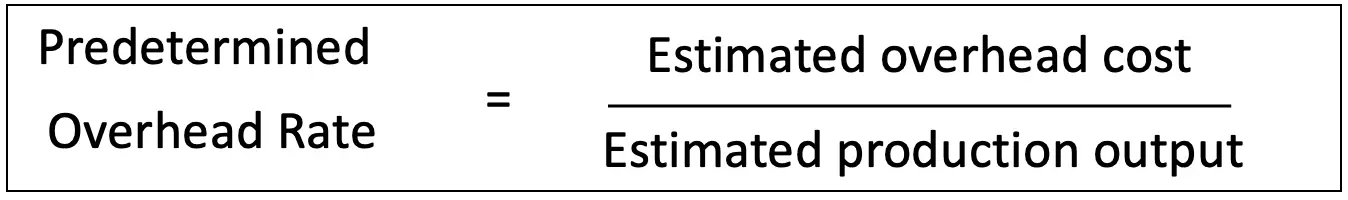

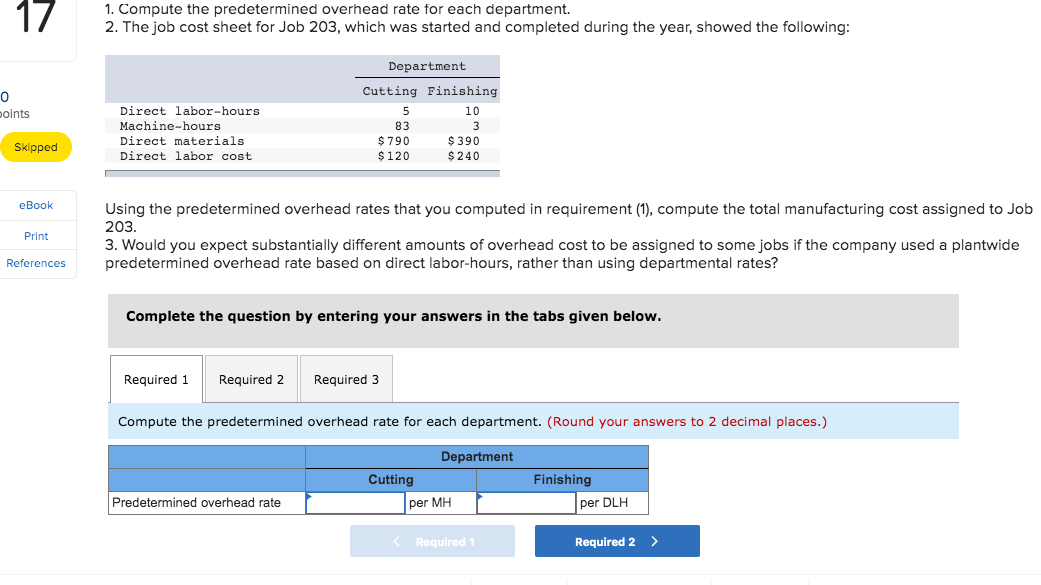

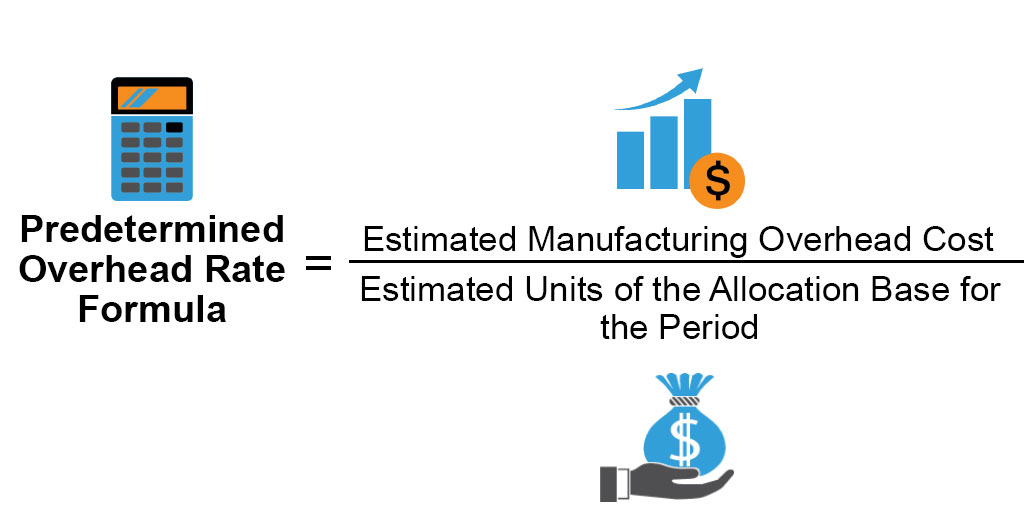

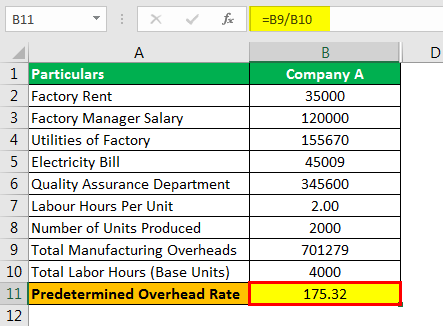

The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated budgeted overhead costs for the year divided by the estimated budgeted level of activity for the year. A pre-determined overhead rate is the rate used to apply manufacturing overhead to work-in-process inventoryThe pre-determined overhead rate is calculated before the period begins.

Pre Determined Overhead Rate Qs Study

Pre Determined Overhead Rate Meaning Calculation And More

With overhead and direct costs in mind such departments can be materials- production- administration- and sales-based.

Predetermined overhead rate. Using the multiple overhead rate means that each production department may have its own predetermined overhead rate. For small widgets the allocation equals 3 ie one hour of labor at 3 per hour. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

There is no efficiency variance for fixed manufacturing overhead. This activity base is often direct labor hours direct labor costs or machine hours. AO R T.

The predetermined overhead rate is a calculation used to determine the estimated overhead costs for individual jobs during a specific time period. The amount of overhead under-absorbed or over-absorbed is transferred to the costing profit and loss account. Most businesses create annual budgets that include estimated overhead and estimated activity for the year.

In this case the applied overhead equaled the actual overhead leaving a zero balance. Finally allocate the overhead by multiplying the overhead rate by the number of labor hours required. The second step is to estimate the total manufacturing cost at that level of activity.

Which of the following is the formula to calculate the predetermined factory overhead rate. Materials requisitions record use of the following materials for the month Job 136 Job 137 Job 138 Job 139 Job 140 Total direct materials Indirect materials Total materials requisitions. Purchased raw materials on credit.

Watercrafts predetermined overhead rate is 200 of direct labor Information on the companys production activities during May follows a. Examples of Manufacturing Overhead in Cost Accounting. Overhead rate is also known as the predetermined overhead rate when budgeted information is used to calculate it.

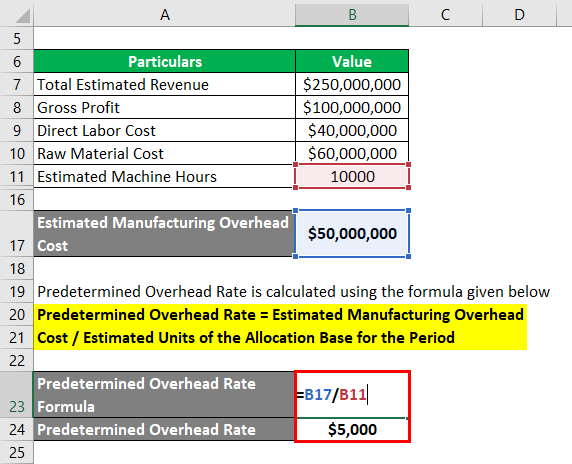

Predetermined Overhead Rate 48000000 150000 hours. When Job MAC001 is completed overhead is 165 computed as 250 times the 66 of direct labor with the total job cost of 931 which includes 700 for direct materials 66 for direct labor and 165 for manufacturing overhead. AR Actual variable overhead rate rate.

April 10 2021 Steven Bragg Cost Accounting. Predetermined overhead rate 1 14 0000 estimated overhead costs 38 000 estimated direct labor hours 3 0 per direct labor hour. If the predetermined overhead rate is applicable for a year it is unproblematic to transfer the differences between the overhead absorbed.

The next graphic provides a visual representation of the cost flow associated with the Factory Overhead account. Predetermined Overhead Rate Formula Example 2. Thus each job will be assigned 30 in overhead costs for every direct labor hour charged to the job.

The fixed overhead production volume variance is the difference between budgeted and applied fixed overhead costs. This means that the predetermined allocation rate was exactly what was incurred during the period. SR Standard variable overhead rate ie variable portion of predetermined overhead rate Example.

The following formula is used to calculate an applied overhead. Using the multiple overhead rate means that each production department may have its own predetermined overhead rate. Predetermined Overhead Rate Definition.

POR MOC UA. Lets assume that a company expects to have 800000 of overhead costs in the upcoming year. It is by means of this method that the overhead rate was calculated in the example.

Example of Applied Overhead. Manufacturing Overhead Cost of Sales Changes in Finished Goods and Work in Process Raw Materials used and Merchandise Purchased Wages and Salaries Post-Employment Benefit Manufacturing Overhead W13239 - W548 W7981 W1654 W070. For example if variable overhead costs are typically 300 when the company produces 100 units the standard variable overhead rate is 3 per unit.

The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated budgeted overhead costs for the year divided by the estimated budgeted level of activity for the year. This activity base is often direct labor hours direct labor costs or machine hours. Definition of Applied Overhead.

The procedure of computing predetermined overhead rate and its use in applying manufacturing overhead has been described in measuring and recording manufacturing overhead cost article. A predetermined overhead rate is computed at the beginning of the period using estimated information and is used to apply manufacturing overhead cost throughout the period. A predetermined overhead rate is an allocation rate that is used to apply the estimated cost of manufacturing overhead to cost objects for a specific reporting period.

Predetermined Overhead Rate 320 per hour. Let us take the example of ort GHJ Ltd which has prepared the budget for next year. This is usually done by using a predetermined annual overhead rate.

Where AO is the applied overhead R is the allocation rate hr T is the total time of production hr Applied Overhead Definition. Applied overhead is the amount of the manufacturing overhead that is assigned to the goods produced. As explained previously the overhead is allocated to the individual jobs at the predetermined overhead rate of 250 per direct labor dollar when the jobs are complete.

Standard variable manufacturing overhead rate. Total Manufacturing Cost Calculator. The first step is to estimate the amount of the activity base that will be required to support operations in the upcoming period.

Where POR is the predetermined overhead rate. It is by means of this method that the overhead rate was calculated in the example. With overhead and direct costs in mind such departments can be materials- production- administration- and sales-based.

This rate is frequently used to assist in closing the books more quickly since it avoids the compilation of actual manufacturing overhead costs as part of the period-end closing process. Therefore the predetermined overhead rate of TYC Ltd for the upcoming year is expected to be 320 per hour. Multiple overhead rate.

Multiple overhead rate. MOC is the manufacturing overhead cost. The SK Manufacturing company has the following data for the month of January 2018.

Predetermined Overhead Rate Formula. Cost accounting is the process of allocating expenses. One important aspect of cost accounting is allocating manufacturing overhead.

The predetermined overhead rate calculation for Custom Furniture is as follows. Actual variable manufacturing overhead. The following equation is used to calculate the predetermined overhead rate.

UA is the unit of allocation. Asked Sep 10 in Other by megha00 Expert 350k points Categories. Accounting for Inventory Activity-Based Costing Cost Accounting Fundamentals.

A predetermined overhead rate is defined as the ratio of. Predetermined Overhead Rate Calculator.

Predetermined Overhead Rate Example Advantage Accountinguide

Predetermined Overhead Rate Formula Calculator With Excel Template

Solved 17 1 Compute The Predetermined Overhead Rate For Chegg Com

Predetermined Overhead Rate Formula How To Calculate

Chapter 3 Predetermined Overhead Rates Flexible Budgets And

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula How To Calculate

Predetermined Overhead Rates And Overhead Analysis In A Standard Costing System Appendix 11a Appendix 11a Predetermined Overhead Rates And Overhead Analysis Ppt Download

0 Response to "Predetermined Overhead Rate"

Post a Comment