Direct Indirect Cash Flow Statement

There are two ways we can build a cash flow statement. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

3

Direct Vs Indirect Cash Flow Statement Excel Model 365 Financial Analyst

Cash Flow Analysis Indirect Format Cash Flow Statements

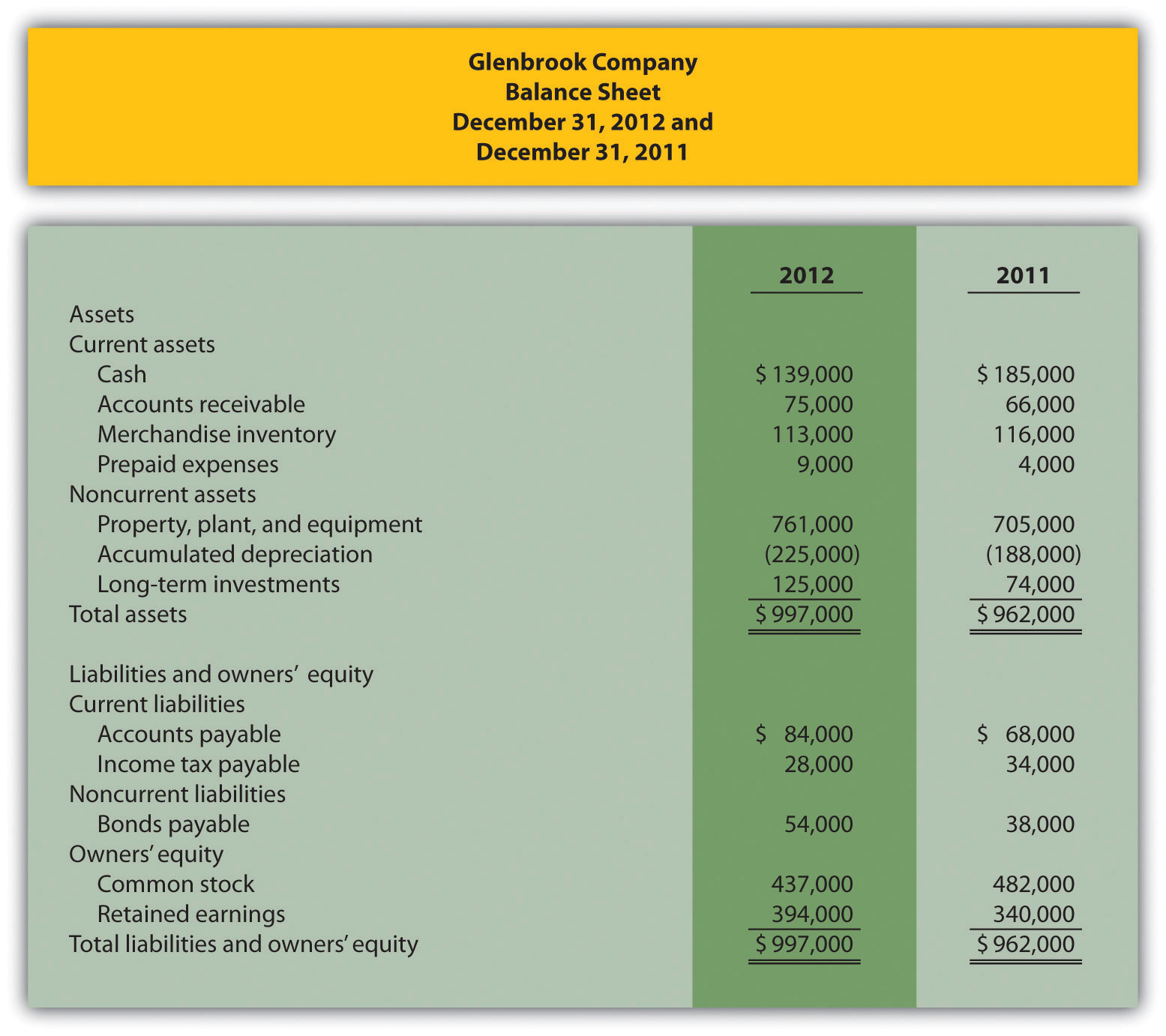

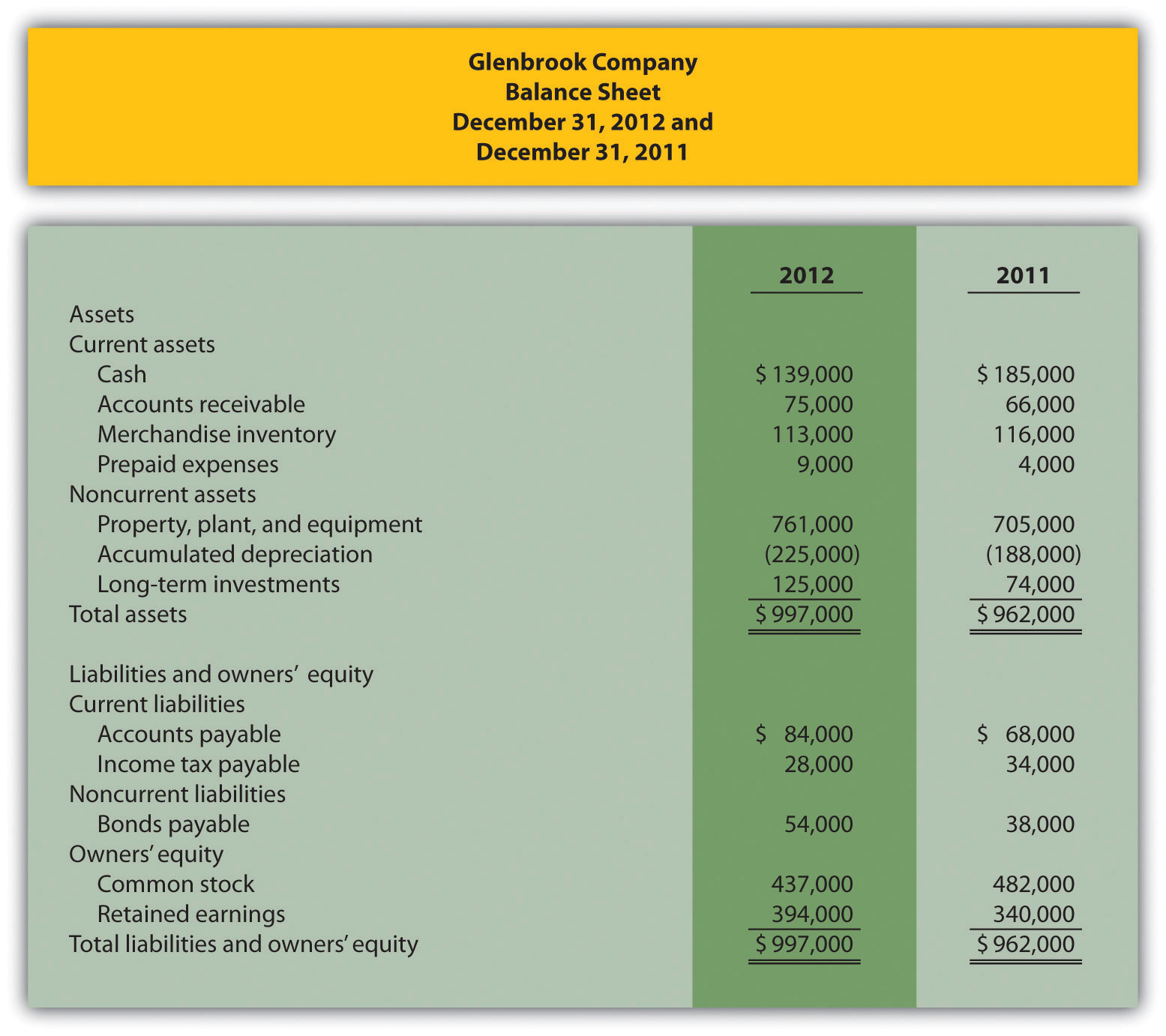

Prepare the cash flow statement using indirect method.

Direct indirect cash flow statement. The first section of a cash flow statement known as cash flow from operating activities can be prepared using two different methods known as the direct method and the indirect method. Because Supplies is a current asset the increase in Cash will appear in. Determine Net Cash Flows from Operating Activities.

The basis for comparison between Direct vs. What is the Cash Flow Statement Direct Method. The Cash flow statement under Direct method is prepared as follows.

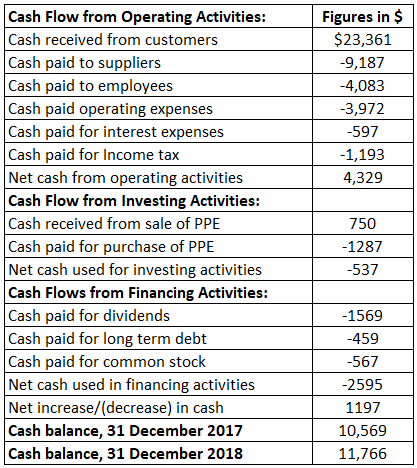

Sample Direct Reporting. Along with balance sheets and income statements its one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow.

The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source. In other words changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to arrive at the operating cash flow. There are two types of cash flows.

Cash flow direct method. Determine Net Cash Flows from Operating Activities. In the indirect method the net income is adjusted for changes in the balance sheet accounts to calculate the cash from operating activities.

Add back noncash expenses such as depreciation amortization and depletion. The calculation starts with the profit or loss before taxation and all non-cash income expenses and items which are included in other line items on the cash flow statements are then added back from the calculated amounts. The cash flow statement previously known as the flow of funds statement shows the sources of a companys cash flow and how it was used over a specific time periodIt is an important indicator of a companys financial health because a company can report a profit on its income statement but at the same time have insufficient cash to operate.

97 Prepare the Statement of Cash Flows Using the Indirect Method. Here we will study the indirect method to calculate cash flows from operating activities. These include payments to suppliers receipts from customers and salaries paid to employees.

Such costs are not paid or dealt with in cash by the firm. All of these are considered to have a positive effect on Cash. The first four Exhibits show the trial balance used to develop the financial statements statement of activities Exhibit 2.

Company Accounts and Analysis of Financial Statements equivalents of an enterprise by classifying cash flows into operating investing and financing activities. The direct cash flow method involves adding up all the cash receipts and payments of a business. The Direct Method or the Indirect Method only apply to the Cash Flow from Operations and do not effect the Cash Flow from Investing or Cash Flow from Financing sections of the Cash Flow Statement.

Using the indirect method operating net cash flow is calculated as follows. The indirect method works from net income so. Direct Cash Flow Method.

In other words it lists where the cash inflows came from usually customers and where. The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. Both ways end up at the same answer but in a different way.

And statement of cash flows Exhibit 4 for a hypothetical NFP entity using the indirect methodThe NFP organizations governing board now desires a cash flow statement that better informs users where the cash. What is the Cash Flow Statement Indirect Method. The statement of cash flows is one of the components of a companys set of financial statements and is used to reveal the sources.

In indirect method the net income figure from the income statement is used to calculate the amount of net cash flow. The main difference between the direct method and the indirect method of presenting the statement of cash flows SCF involves the cash flows from operating activities. But because most accounting reports dont include the necessary information the direct method requires many businesses choose to take the easier route and produce their statements of cash flow.

Cash flow indirect method. Add back noncash expenses such as depreciation amortization and depletion. Items that typically do so include.

The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in. The cash flow statement can be prepared using either the direct or indirect method. The Cash Flow Statement Indirect Method is one of the two ways in which Accountants calculate the Cash Flow from Operations another way being the Direct Method.

Reduces profit but does not impact cash flow it is a non-cash expense. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. A statement of cash flows can be prepared by either using a direct method or an indirect method.

The statement of cash flows is prepared by following these steps. Begin with net income from the income statement. The cash flow statement is reported in a straightforward manner using cash payments and receipts.

Statement of position Exhibit 3. The indirect method uses net income as a base and adds non-cash expenses Non-cash Expenses Non-cash expenses are those expenses recorded in the firms income statement for the period under consideration. Cash collected from customers.

Supplies on Hand is a current asset accountA decrease in any asset account balance other than Cash is assumed to be a source of Cash provided Cash increased Cash or have used less Cash than the amount of Supplies Expense shown on the income statement. Unlike the indirect method when cash flow statements are generated through the direct method its considerably easier to see where cash payments were made and where cash payments were received. Cash Flow Statement 6 2021-22.

Being the simpler of the two it is the method of choice for most Accountants and is therefore seen applied in the Cash Flow Statement for most Businesses. A detailed calculation of this amount is included below the cash flow statement on the Direct sheet and at the top of the cash flow statement on the Indirect sheet. Using the indirect method operating net cash flow is calculated as follows.

Cash paid to employees. The direct method the income statement is reformulated on a cash basis rather than an accrual basis from the top of the statement the income part to the bottom the expense part. The cash flow from financing and investing activities sections will be identical under both the indirect and.

Begin with net income from the income statement. The statement of cash flows is prepared by following these steps. Using the indirect method actual cash inflows and outflows do not have to be known.

First lets take a closer look at what cash flow statements do for your. Interest and dividends received. There are no differences in the cash flows from investing activities andor the cash flows from financing activities.

The Direct Method is the preferred method by FASB but due to its laborious nature most Accountants prefer the Indirect Method. In this method the opening and closing balance of various accounting heads. Illustration of an Indirect method.

Cash paid to suppliers. The fundamentals of preparation of cash flow statement under Direct method is more or less same as in Indirect method with only a few exceptions in terms of its presentation.

Direct Vs Indirect Method Of Cash Flows Accountingexplanation Com

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

Cash Flow Statements Reviewing Cash Flow From Operations

3

2 An Example Of The Cash Flow Statement With Indirect Method Download Table

Cash Flow Definition Example Top 3 Types Of Cash Flow

Appendix Using The Direct Method To Prepare The Statement Of Cash Flows

The Essential Guide To Direct And Indirect Cash Flow

How To Create A Cash Flow Statement Using The Indirect Method The Blueprint

0 Response to "Direct Indirect Cash Flow Statement"

Post a Comment