Statement Of Retained Earnings

If the net loss for the current period is higher than the retained earnings at the beginning of the period those retained earnings on the balance sheet may become negative. What is retained earnings.

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Related

What Are Retained Earnings Daily Business

Lets say that the net income of your company is 15000.

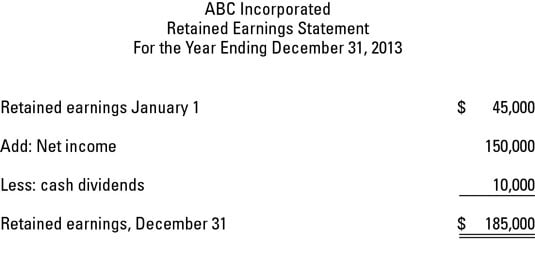

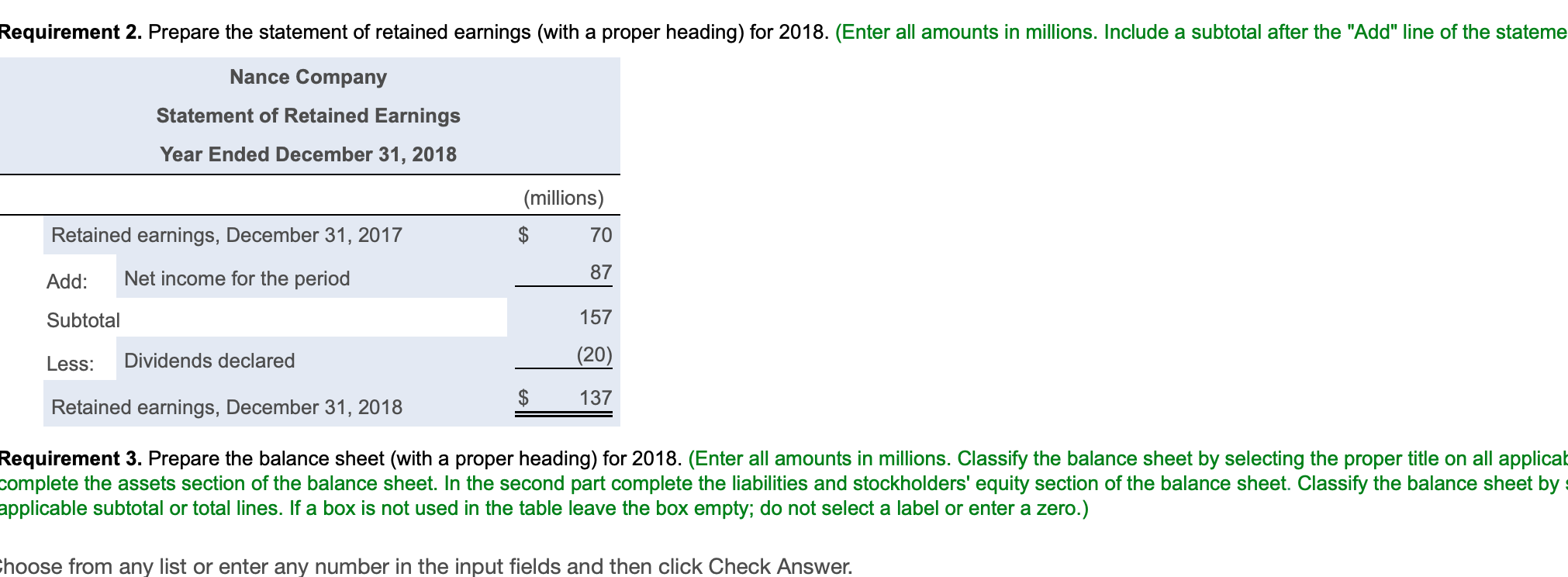

Statement of retained earnings. The statement of retained earnings shows whether the company had more net income than the dividends it declared. But unlike accounts in the income statement which are temporary accounts subject to closure at the end of an accounting period the account of retained earnings is a permanent account. The statement of retained earnings is a financial statement that summarizes the changes in the amount of retained earnings during a particular period of time.

The retention ratio is the percentage of net income that is retained. It shows your revenue minus your expenses and losses. Enter the PL statement account type to determine the retained earnings account for each PL accountIf you are creating a PL account you must make an entry here.

Retained earnings is the corporations past earnings that have not been distributed as dividends to its stockholders. The statement is most commonly used when issuing financial statements to entities outside of a business such as investors and lendersWhen financial statements are developed strictly for internal use this statement is usually not included on the grounds that it is not needed from an operational perspective. Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders.

Instead it is retained for investments in working capital andor fixed assets as well as to pay down any liabilities outstanding. For example if 60 of net income is paid out as dividends. The statement of retained earnings is a financial statement that is prepared to reconcile the beginning and ending retained earnings balances.

Retained earnings are an integral part of equity. Retained earnings represent a useful link between the income statement and the balance sheet as they are recorded under shareholders equity which connects the two statements. The retained earnings portion of stockholders equity typically results from accumulated earnings reduced by net losses and dividends.

Some of the information that external stakeholders are interested in is the. Before Statement of Retained Earnings is created an Income Statement should have been created first. The balance sheet lists the assets liabilities and equity including dollar amounts of a business organization at a specific moment in time and proves the accounting equation.

The statement of retained earnings retained earnings statement is defined as a financial statement that outlines the changes in retained earnings for a specified period. Dividends paid are the cash and stock dividends paid to the stockholders of your company during an accounting period. Paid-in capital is the actual investment by the stockholders.

Locate and select the Profit and Loss report. In the next screen Enter the following information. In the balance sheet.

The ending retained earnings is used by the balance sheet. To see what makes up your Retained Earnings you have to run your previous years Profit and Loss statement. Accumulated earnings of the organization for the reporting year is the final financial result of its activities fewer dividends paid.

This creates a deficit. Retained earnings a balance-sheet account is a form of income that a company has earned over time. Companies must exclude the effect of prior period adjustments from current financial statements since the changes have no relationship to the current statement period.

Retained Earnings is a permanent account that appears on a businesss balance sheet under the Stockholders Equity heading so you will always know where this number will go on this financial statement. Also sometimes called a net income statement or a statement of earnings the income statement is one of the three most important financial statements in financial accounting. What is an income statement.

The earnings of a corpoartion are kept or retained and are not paid out directly to the owners while the earnings are immediately available to the business owner in a sole proprietorship unless the owner elects to keep the money in the business. Like paid-in capital retained earnings is a source of assets received by a corporation. Retained earnings is the investment by the stockholders through earnings not yet withdrawn.

Before retained earnings is adjusted on the income statement the business must first make all necessary adjustments to its expense and revenue accounts to record the activity of the financial period which includes adjustments for expenses that accumulate over time such as depreciation or accrued rent and salaries. The statement of retained earnings retained earnings statement is defined as a financial statement that outlines the changes in retained earnings for a specified period. Retained earnings is the portion of net income that a company does not distribute among its shareholders but retains in the business for various purposes such as growth of business in future and meeting the debt obligations etc.

Net Income 2018. A statement of retained earnings is a depiction of the movement in retained earnings in a given period. In other words the uncovered loss is the loss that occurred when the enterprise experienced an actual loss and was unable to cover it with retained earnings.

Since all profits and losses flow through retained earnings any change in the income statement item would impact the net profitnet loss part of the retained earnings formula. Retained earnings is the cumulative amount of earnings since the corporation was formed minus the cumulative amount of dividends that were declared. That is the first item added to Statement of Retained Earnings.

The retained earnings formula is a calculation that derives the balance in the retained earnings account as of the end of a reporting period. Retained earnings reflect the companys accumulated net income or loss less cash dividends paid plus prior period adjustments. An income statement is a financial statement that shows you how profitable your business was over a given reporting period.

The purpose of retaining these earnings can be varied and includes buying new equipment and machines spending on research and development or other activities that could potentially generate growth for the company. Are Retained Earnings an Asset. The Retained Earnings account is a rollover of all previous fiscal years net profit.

The Retained Earnings Statement will looks like this. The statement of retained earnings is mainly prepared for outside parties such as investors and lenders since internal stakeholders can already access the retained earnings information. Terms Similar to the Statement of Retained Earnings.

Definition of Retained Earnings. View the Profit and Loss Detail report. A month and its end.

It outlines the earnings that were present at the beginning of the year the portion that was transferred from the current years profits and thus resulting in the earnings as at the year-end. To view the Profit and Loss report. The result of your calculation is the value that will be recorded in the equity section of the balance sheet as well as in the statement of retained earnings.

The statement of retained earnings is also important for business management as it allows the firm to determine its retention ratio. Retained earnings are a total of all the accumulated profits that a company has received and has not distributed or spent otherwise. The statement of retained earnings shows the change in retained earnings between the beginning of the period eg.

Retained earnings is that portion of the profits of a business that have not been distributed to shareholders.

Statement Of Retained Earnings A Comprehensive Guide

Ayeyarhinthar Com

How To Create A Statement Of Retained Earnings For A Financial Presentation

How To Find The Statement Of Retained Earnings In A Company S 10 K

What Are Retained Earnings Dummies

Solved Requirement 2 Prepare The Statement Of Retained Chegg Com

How To Prepare Retained Earnings Statement Example Format Bookstime

What Information Is Provided In Mcdonald S Basic Financial Statements Accounting In The Headlines

0 Response to "Statement Of Retained Earnings"

Post a Comment