Common Equity Formula

The formula for calculating the book value per share of common stock is. Vertical analysis also known as common-size analysis is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

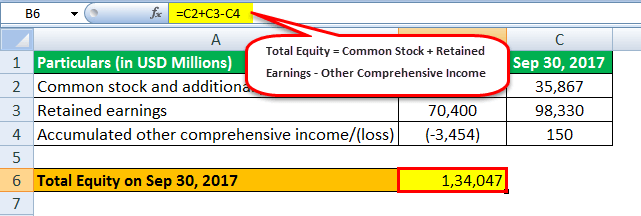

How Do You Calculate Shareholders Equity

The Cost Of Capital 1 Learning Goals Sources

5 Ways To Improve Return On Equity The Motley Fool

Return on Equity ROE is the ratio that mostly concerns shareholders management teams and investors in terms of.

Common equity formula. It is often used as a proxy for cash flow and can help provide an estimated valuation range for your company overall by using the EBITDA multiple. The formula for common size analysis is. The implementation of CET1 started in 2014 as part of Basel III regulations relating to cushioning a local economy from a financial crisis.

LCM stands for Least Common Multiple. It keeps on changing as per the performance of the company and the perception of the investors towards a company. It can be represented with the accounting equation.

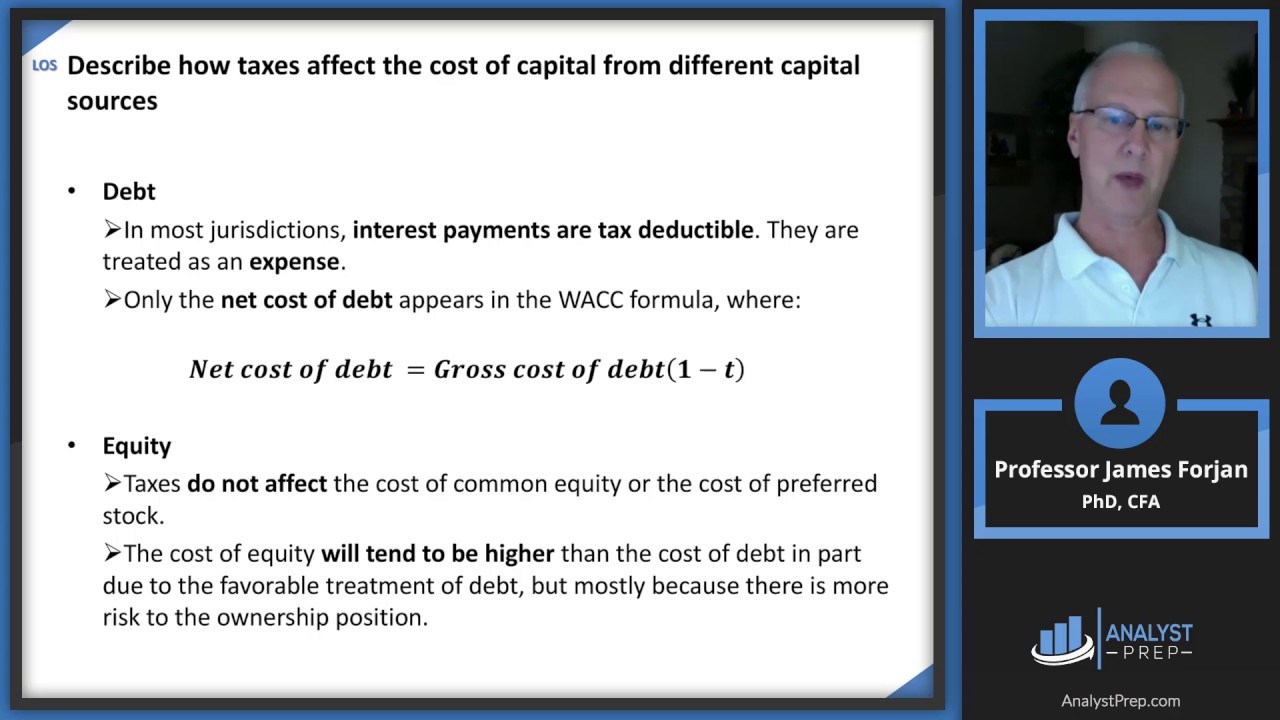

Also known as LCD Least Common Divisor. Return on Equity ROE is one of the Financial Ratios use to measure and assess the entitys profitability based on the relationship between net profits over its averaged equity. Recall the WACC formula from earlier.

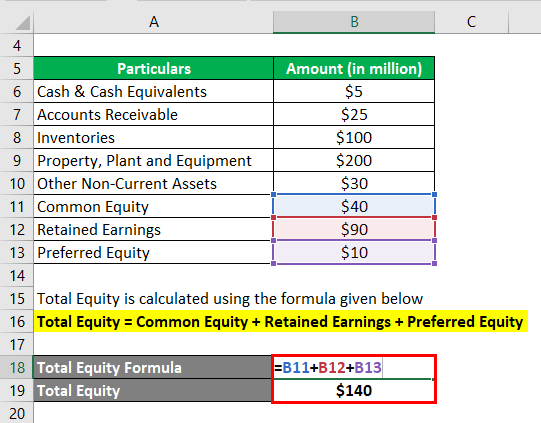

In this case preferred dividends are not included in the calculation because these profits are not available to common stockholders. Cash Dividends on Common Stock. If preferred stock is not present the net income is simply divided by the average common stockholders equity to compute the common stock equity ratio.

Two main important elements of this ratio are Net Profits and Shareholders Equity. Statement of Stockholders Equity Earnings Per Share Other. Common stock is reported in the stockholders equity section of a companys balance sheet.

Common stockholders are lower down on the list of priorities when it comes to paying equity holders. If a company needs to liquidate holders of common stock will get paid after preferred. The equity value formula yields the value that is a combination of the total shares outstanding and the market price of the share at a particular point in time.

A cost of debt rdebt and a cost of equity requity both multiplied by the proportion of the companys debt and equity capital respectivelyCapital structure a companys debt and equity mix. Using the formula provided above we arrive at the following figures. EV 500000 QV 100000 ND 400000 So back to out new analysts question.

Does adding debt and subtracting cash increase a companys value. Common Equity Tier 1 CET1 is a component of Tier 1 Capital and it encompasses ordinary shares and retained earnings. The Shareholders Equity Statement on the balance sheet details the change in the value of shareholders equity from the beginning to the end of an accounting period.

Read more such as common stock additional paid-in capital Additional Paid-in Capital Additional paid-in capital or capital surplus is the companys excess amount received over and above the par value of shares from the. LCM is the smallest common multiple divisible for any two or more numbers. As you can probably guess this method of calculating the cost of equity only works for investments that pay dividends.

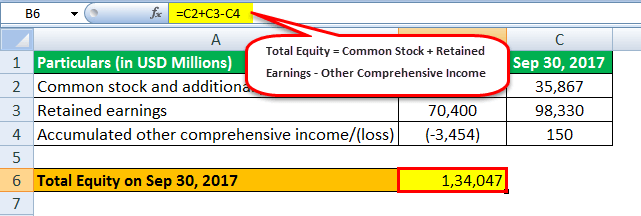

As per the second method stockholders equity formula can be derived by using the following steps. Now that weve covered the high-level stuff lets dig into the WACC formula. To conduct a vertical analysis of balance sheet the total of assets and the total of liabilities and stockholders equity are generally used as base figures.

Common Stock Total Equity Preferred Stock Additional-paid in Capital Retained Earnings Treasury Stock. Most of the time ROE is computed for common shareholders. The return on common equity has been consistently trending up from 2015-2017 before dipping in 2018 due to a large equity issue.

Learn an easy method to find LCM at BYJUS. For example if there are 10000 outstanding common shares of a company and each share has a par value of 10 then the value of outstanding share amounts to 100000. Cash dividends usually referred to as dividends are a distribution of the corporations net income.

This considers the sale of stock that an issuer directly. Generally speaking equity is the value of an asset less the amount of all liabilities on that asset. Plugging these data points into our enterprise value formula we get.

While it is arrived at through and common equity. Relevance and Uses of Common Stock Formula. Return on Equity Net Income Average Common Stockholder Equity for the Period ROE 01047 or 1047 By following the formula the return XYZs.

The DDM formula for calculating cost of equity is the annual dividend per share divided by the current share price plus the dividend growth rate. Notice there are two components of the WACC formula above. LCM of 3 4 is 12.

Book value per share Stockholders equity Total number of outstanding common stock. Key Takeaways Common stock is a security that represents ownership in a corporation. Assets -Liabilities Equity.

Firstly collect paid-in share capital Paid-in Share Capital Paid in Capital is the capital amount that a Company receives from investors in exchange for the stock sold in the primary market including common or preferred stock. The common stock is very important for an equity investor as it gives them voting rights which is. The return on equity ratio formula is calculated by dividing net income by shareholders equity.

On the other hand the equity value represents only the value to the contributors of equity into the business. It is a better practice to use the average figures of common and preferred stock but if only closing figures are available they can be used to compute common stockholders equity denominator of the formula. Above all else EBITDAs importance is now as the standout formula and language applied by professional buyers private equity investors and more when discussing business value.

Dividends are analogous to drawswithdrawals by the owner of a sole proprietorship. Thank you for reading this CFI article on the Return on Common Equity ratio. Analysis Amount Base Amount x 100 On the balance sheet the base amount is total assets or total liabilities and owners or shareholders equity.

Equity Formula Definition How To Calculate Total Equity

Equity Ratio Formula Calculator Examples With Excel Template

Solved Calculating The Average Common Stockholders Equity And Th Chegg Com

Cost Of Equity Capital Corporate Finance Cfa Level 1 Analystprep

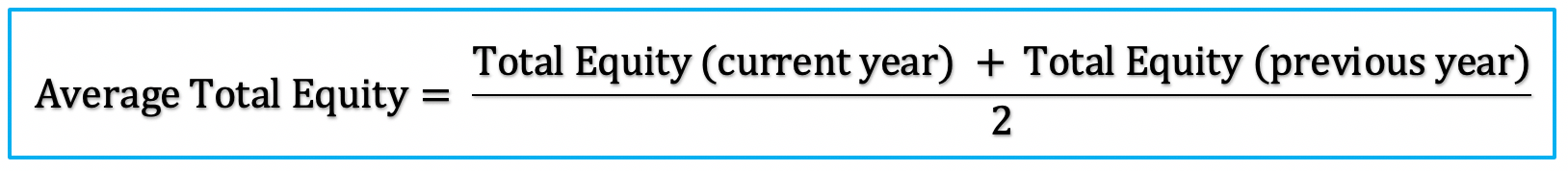

Average Total Equity Explanation Formula Example Accountinguide

The Balance Sheet Stockholders Equity

The Balance Sheet Stockholders Equity

Paid In Capital And Retained Earnings Accountingcoach

0 Response to "Common Equity Formula"

Post a Comment