Import Tariff Graph

An increase in the terms of trade generally means that relatively more Australian dollars will be needed to purchase Australian exports or less foreign currency will be needed to purchase foreign imports. Todays Outlook charts are designed to summarize forecasts and actual loads.

Tariffs And Quotas Economics Online Economics Online

File Effectoftariff Svg Wikimedia Commons

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

The Basics Of Tariffs And Trade Barriers

Ellens country often faces formal trade barriers.

Import tariff graph. Hawley it was signed by President Herbert Hoover on June 17 1930. The graph is seen below. The sum of the losses in the world exceeds the sum of the gains.

This tariff search tool allows users to find tariff information on all products covered under the US. The demand and net demand trend data do not include dispatchable pump loads or. The FTA Tariff Tool combines tariff data into a simple and easy to search public interface.

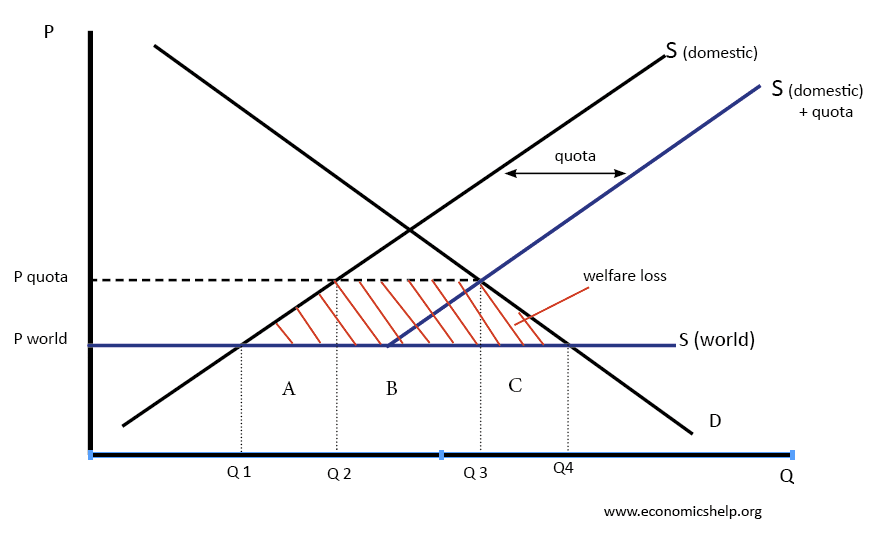

Use this number for import paperwork and electronic filing. An import tariff lowers consumer surplus and raises producer surplus in the import market. Once the quota period for a commodity ends information for the new period is captured when the report is run.

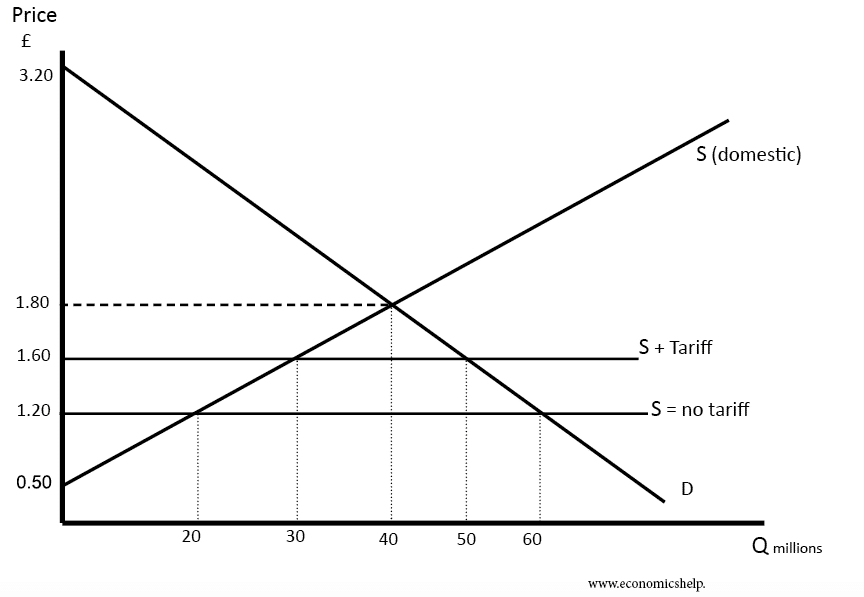

What would the price of wheat be in the absence of trade. Some imports have much higher tariffs. The 15 is a price increase on the value of the automobile so a.

Trade freedom is a composite measure of the absence of tariff and non-tariff barriers that affect imports and exports of goods and services. Venezuelas economic freedom score is 247 making its economy the 177th freest in the 2021 Index. Use this number for export paperwork and EEI filing.

For example the US. Trade Market for Wheat Q P PPP PP PP. Building upon existing tax and trade systems will avoid.

Go to the Commodity Graph Report for current fill levels. Merchandise import price index for electrical wires and cables in Vietnam 2014-2020 Per capita income in Chandigarh India FY 2012-2019 Fiscal balance as. Indicate the new level of imports with the tariff and the quota.

They can import more than 90 tonnes but must pay an import duty of 15. Derive and graph Homes import demand schedule. A tariff is a tax on imported goods and services.

Subsection b of such Public Law provides. For example suppose the import quota is 90 tonnes and the importer pays a duty of 6. Ignore the effect on the deficit.

Israel FTA Tariff tool. The Tariff Act of 1930 codified at 19 USC. An import tariff by a small country has no effect on consumers producers or national welfare in the foreign country.

Use a border adjustment to stop business relocation. Calendar year-end snapshot status reports for imported merchandise subject to tariff rate quotas and tariff preference levels. The national welfare effect of an import tariff is evaluated as the sum of the producer and consumer surplus and government revenue effects.

A tariff is not considered efficient as a result. What would the price of wheat be in the absence of trade. Draw a graph of the market for loanable funds being careful to.

Now that you have a good grasp on how trade and tariffs impact the supply and demand graph practice with these graphs in the shading practice or important prices points and quantities game. 701 TARIFF ACT OF 1930 246 41 Section 1a of Public Law 11299 adds a new subsection f to section 701. Import duties or custom duty tax may be applied to protect local production to penalize the country of import to penalize a product that would be sold below fair market value anti-dumping or simply as a source of government.

An important influence on the Australian dollar has been movements in our terms of trade - the ratio of export prices to import prices Graph 3. Go to the TPL Threshold to Fill List to see almost closed and closed quotas. On another graph how the increased desire to save will.

The average tariff on dutiable imports in the United States that is those imports on which a tariff is imposed is about 4. USA Harmonized Tariff Schedule codes HTS-US are used for import categorization. Identify the variables determining the curves and to label the axes.

Furthermore the government can also apply a tariff-rate quota. Individual tariff items may be looked up using the Department of Commerce tariff tool. On the diagram indicate the tariff rate and the equivalent import quota Q that would generate the same domestic price.

The quantity of imports and exports is shown as the blue line segment on each countrys graph. Simply enter your product and select the country youre exporting to or importing from. A common barrier is a tariff.

Derive and graph Homes import demand schedule. As a signatory to the HS Convention the USA uses the six-digit HS System categorization. Its overall score has decreased by 05 point primarily because of a decline in the score for.

Our Canada Tariff Finder tool is so intuitive it gives tariff rates even without the HS code. Import fees on products imported from countries without a carbon fee along with rebates to US industries exporting to those countries will discourage businesses from relocating where they can emit more CO 2 and motivate other countries to adopt similar carbon pricing policies. Next suppose there is a decrease in domestic demand for the good.

An import or export tariff. The Laffer curve is typically represented as a graph that starts at 0 tax zero revenue rises to a maximum rate of revenue raised at an intermediate rate of taxation and then falls again to zero revenue at a 100 tax rate. Non-calendar year quota periods may already be in progress.

In other words we can say that an import tariff results in a reduction in world production and consumption efficiency. An example of an ad valorem tariff would be a 15 tariff levied by Japan on US. Quickly get tariff information for specific products and countries where Canada has a Free Trade Agreement.

Import demand is given by the equation MDP SP DP 80 40P. Schedule B codes are used for export categorization. 4 commonly known as the SmootHawley Tariff or HawleySmoot Tariff was a law that implemented protectionist trade policies in the United StatesSponsored by Senator Reed Smoot and Representative Willis C.

Indicate on the graph the new equilibrium with the tariff in place and the quota in place. The absence of trade is the equivalent to import demand being zero which happens at P 2. B EFFECTIVE DATESubsection f of section 701 of the Tariff Act of 1930 as added by sub- section a of this section applies to 1 all proceedings initiated under subtitle A of title VII of that Act 19 USC.

The act raised US tariffs on over 20000 imported goods. The trade freedom score is based on two inputs. Free Trade Agreements FTAs with the tariff applied on the date the FTAs enters into force and each year as the tariffs are eliminated.

Suppose that there is a change in tax laws making it more attractive for. 2014 Year-End Commodity Graph Report. The government still allows imports over the quota but has to pay high import duties for each additional quantity.

Import quotas have a similar impact on a domestic market as tariffs do. Israeli goods enter the commerce of the United States duty free. A customs duty sometimes called an import duty is a tax applied to products imported for resale.

International Trade Theory and Policy - Chapter 90-8. Tariff on imported frozen orange juice is 35 cents per gallon which amounts to about 40 of value.

Effect Of Import Quotas Economics Help

Tariff Rate Quotas Different Cases Of Quota Fill Download Scientific Diagram

Trade Chapter 90 8 Welfare Effects Of A Tariff Large Country

Tariffs And Quotas Economics Online Economics Online

1

Ged Explains Import Tariffs Vs Import Quotas Ged Project

Effect Of Tariffs Economics Help

4 9 Tariffs Principles Of Microeconomics

0 Response to "Import Tariff Graph"

Post a Comment