Double Entry For Disposal Of Asset

1000 Accumulated Depreciation Account Dr. I hope you liked this tutorial on the asset retirement by scrapping using ABAVN in SAP.

Disposal Of Pp E Principlesofaccounting Com

Disposal Involving Trade In Open Textbooks For Hong Kong

Fixed Asset Accounting Disposal Of Fixed Asset Accounting Corner

Refillable CBD vape pens come in various styles but most are relatively discreet.

Double entry for disposal of asset. If asset appreciation exceeds accumulated impairment losses a double entry should be made in the general journal. 3 Duality double entry and the accounting equation Each transaction that an entity enters into affects the financial statements in two ways. Treasurers accounts of the city of Genoa in 1340.

Once again although it is possible to create a double-entry accounting system in Excel it would be extremely troublesome and time-consuming to manage and maintain. The balance sheet of a firm records the monetary value of the assets owned by. Debit the cash account in a new journal entry in your double-entry accounting system by the amount for which you sold the business property.

As we mentioned briefly above if you think your business will benefit from a double-entry bookkeeping system youll definitely want to look for an alternative solution. Depreciation Journal Entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear normal usage or technological changes etc. Available to be used by.

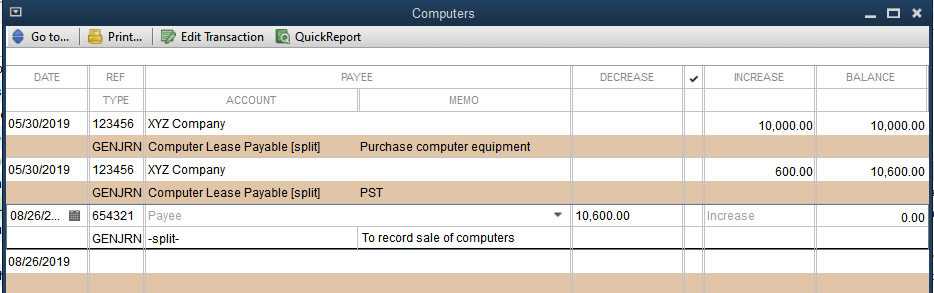

Some time ago I published an article with an example of very simple method of consolidating a parent and a subsidiary. Disposal of Fixed Assets Double Entry Example. This article still applies and you Step-by-step solved example about deconsolidation when a parent loses control and disposes of a subsidiary with IFRS 10 rules explained.

Fixed Asset Trade In Journal Entry. Learn how to do it. The double entry for the part exchange value is.

Sell goods on credit. 1 it has increased the vehicle assets it has at its disposal for generating. Note that the proceeds on the disposal of an asset can never be less than nil even if a loss is made on the disposal of an asset because the proceeds equal the amount that is received after selling the asset.

The act of getting rid of something especially by throwing it away. A CBD vape pen is a pen-shaped device used for vaping CBD e-juiceThere are two categories. A nil value may however need to be entered if an asset.

Used for incorporating and reporting the financial results of majority-owned investments. The nature of doubleentry bookkeeping. First calculate the straight-line depreciation rate.

Thus the asset and liability sides of the transaction are equal. A useful or valuable quality skill or person. An investment is any asset or instrument purchased with the intention of selling it for a price higher than the purchase price at some future point in time capital gains or with the hope that the asset will directly bring in income such as rental income or dividends.

Entry fields provided on page 4 Eircode. For example suppose a business has an asset with a cost of 1000 100 salvage value and 5 years useful life. ABC Company pays 29000 on existing supplier invoices.

I have created an account which corresponds to my account with a share broker. A business has fixed assets that originally cost 9000 which have been depreciated by 6000 to the date of disposal. Fixed Asset Account - Acquisition Value Cr.

Gain on disposal is calculated by subtracting the accumulated depreciation from the original cost of an asset and then adding the sales amount. I assume that the carrying amount of the asset was higher than 500. In financial accounting an asset is any resource owned or controlled by a business or an economic entity.

The fixed asset trade in transaction is shown in the accounting records with the following bookkeeping entries. Tracking share purchases in a double-entry bookkeeping system goes outside my knowledge and I would be glad of advice. When I pay the broker money I do a transfer from my bank account to the brokers account which leaves a cash balance with the broker.

A debit increases the cash account which is an asset. A buyer paid 54000 cash for the asset which results in a gain on. Thus the asset and liability sides of the transaction are equal.

The Messari accounts contain debits and credits journalised in a bilateral form and carry forward balances from the preceding year and therefore enjoy general recognition as a double-entry system. Journal Entry For Depreciation. The two effects on the entity are.

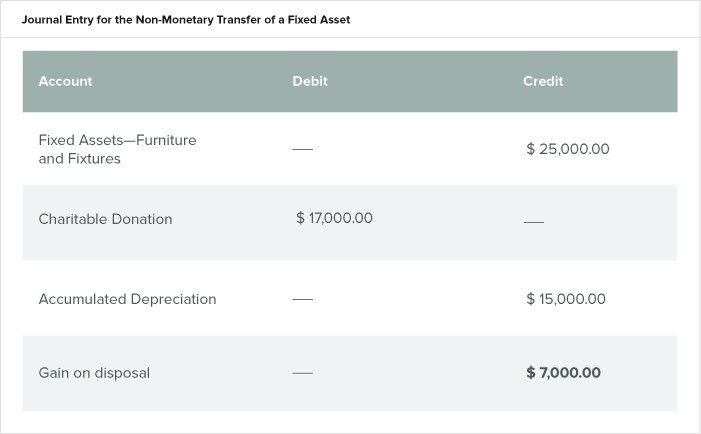

Since it was exchanged for fair value of 5000 and had a net book value of 6000 17000 11000 the loss on disposal must have been 1000. Enter amount of net gain on disposal of chargeable business assets. Journal Entry for Gain on Disposal.

Credit the disposal account as these are the effective proceeds of the old asset debit the new asset cost account as. Double Taxation Relief If you wish to claim relief for foreign tax in respect of a disposal that gives rise to a liability to capital gains tax shown above. Since the asset has 5 years useful life the straight-line depreciation rate equals 100 5 or 20 per year.

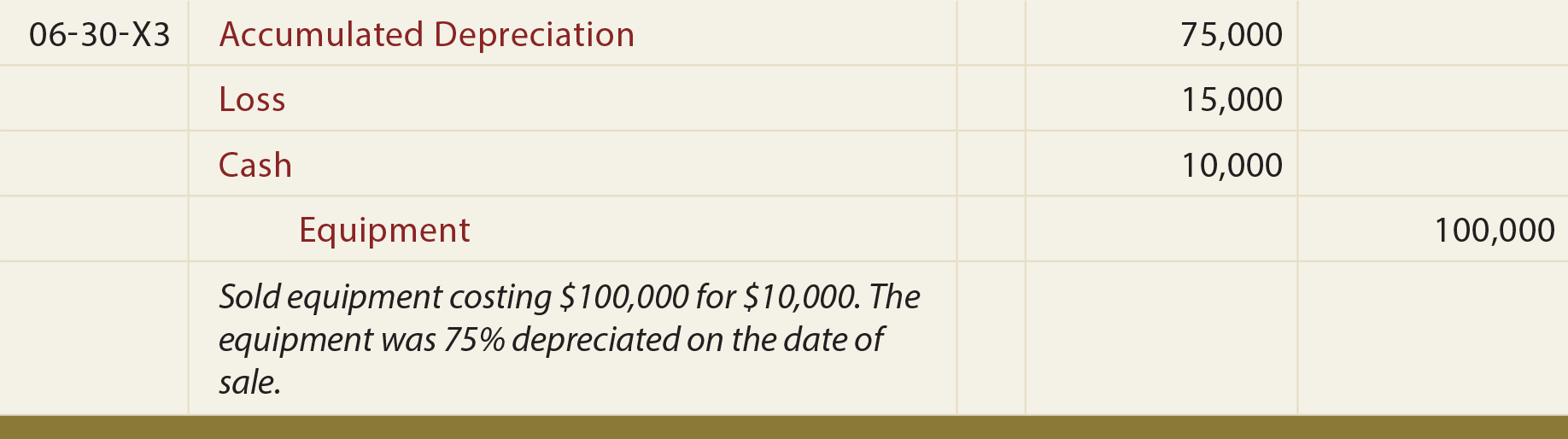

It is anything tangible or intangible that can be used to produce positive economic valueAssets represent value of ownership that can be converted into cash although cash itself is also considered an asset. The entry would be Debit Provision for decommissioning 500 Credit an asset 500. A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a loss on disposal.

The first one debits Accumulated Impairment Losses and credits Gain on Revaluation for the whole amount of relevant accumulated impairment losses. IBM Developer More than 100 open source projects a library of knowledge resources and developer advocates ready to help. For example an entity may buy a vehicle for cash.

If you have any feedback please go to the Site Feedback and FAQ page. The oldest discovered record of a complete double-entry system is the Messari Italian. The following accounting entry is posted in ABAVN in SAP.

In this example the asset was purchased for 100000 and accumulated depreciation is 80000. If the asset is still used in the companys operations the assets account and accumulated depreciation will still be reported on the companys balance sheet. Where depreciation account will be debited and the respective fixed asset account will be.

Something valuable belonging to a person or. 2083 GainLoss of Fixed Asset Disposal Dr. This reduces the cash Asset account by 29000 and reduces the accounts payable Liability account.

Here you did not give me the carrying amount of a related asset just a part of it equal to ARO asset removal obligation by the way this is US GAAP term not an IFRS term. The reported assets value and accumulated depreciation will be equal but no entry will be required until the asset is disposed of.

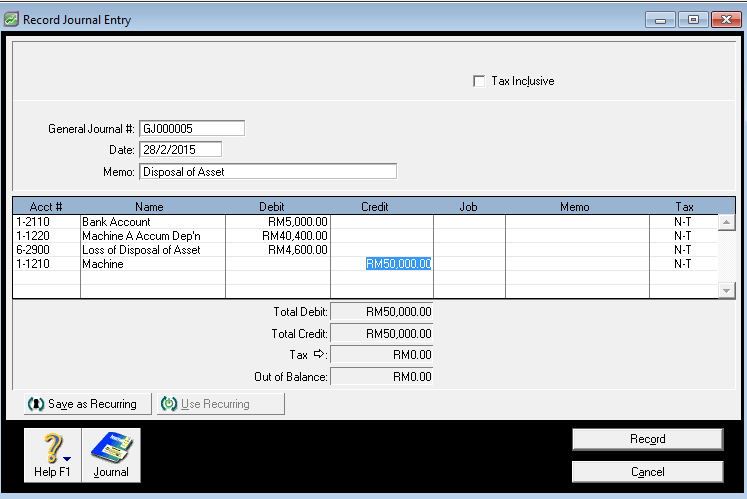

Fixed Asset Disposal Abss Support

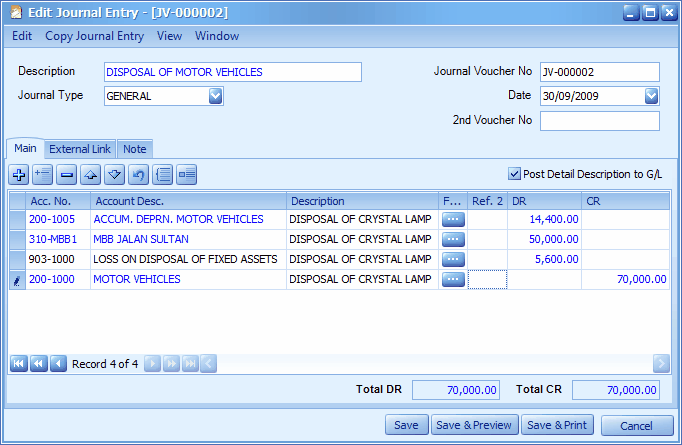

Autocount Accounting Help File 2009

How Do I Remove A Fixed Asset An Old Vehicle That

Disposing Of Fixed Assets

Disposal Of Fixed Assets Solarsys

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

Fixed Asset Accounting Made Simple Netsuite

Fixed Asset Trade In Double Entry Bookkeeping

0 Response to "Double Entry For Disposal Of Asset"

Post a Comment