Cash Flow From Financing Activities

In financial accounting a cash flow statement also known as statement of cash flows is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activitiesEssentially the cash flow statement is concerned with the flow of cash in and out of the business. Operating Cash Flow Operating Cash Flow Operating Cash Flow OCF is the amount of cash generated by the regular operating activities of a business in a specific time period.

Cash Flow From Financing Activities Overview Examples What S Included

Who Classifies Interest Payments As Financing Activities An Analysis Of Classification Shifting In The Statement Of Cash Flows At The Adoption Of Ifrs Sciencedirect

How To Read A Cash Flow Statement And Understand Financial Statements

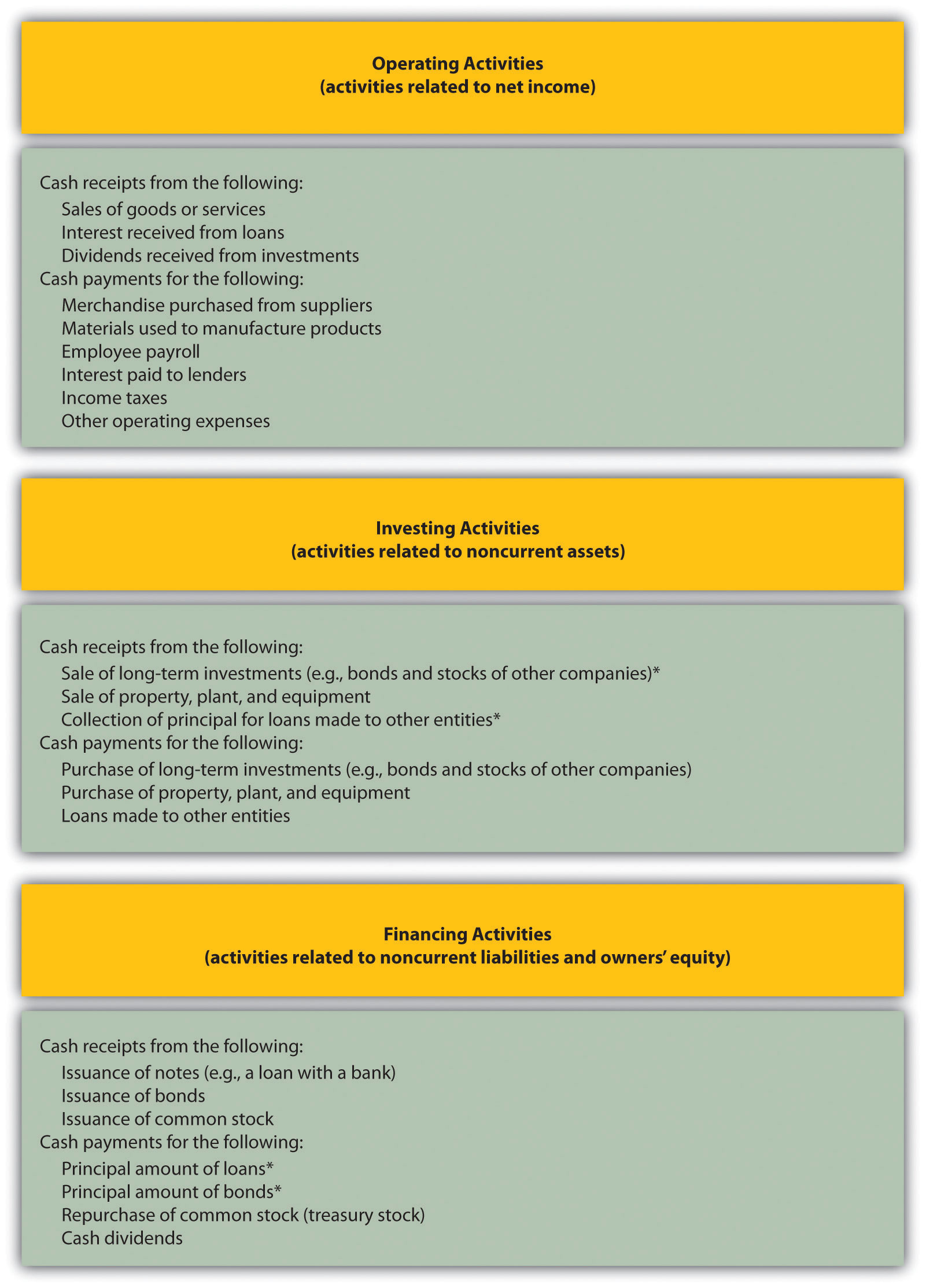

Cash Flows from Operating Activities These are cash inflows and outflows directly related to your core business operations.

Cash flow from financing activities. Finance activities include the issuance and repayment of equity Equity In finance and accounting equity is the value attributable to a business. Cash flows from operating activities result from providing services and producing and delivering goods. Cash Inflow from Financing Activities.

Cash flow from financing activities refers to inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of securities like equity share preference shares issuing debt debentures and from the redemption of securities or repayment of a long term or short term debt payment of dividend or interest on securities. Cash Flows from Operating Activities. Cash flows are classified and presented into operating activities either using the direct or indirect method investing activities or financing activities with the latter two categories generally presented on a gross basis.

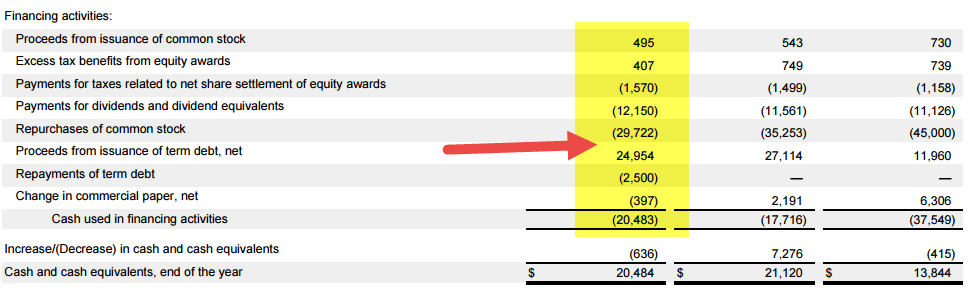

The Financing Activities section shows how borrowing affects the companys cash flow. Examples of Financing Activities. Its one of the three sections on a companys statement of cash flows the other two being operating and investing activities.

When capital is raised it is considered cash in. Receipts on the issuing of shares and other debt instruments. Cash flows from financing activities are the cash paid and received from activities with non-current or long-term liabilities and shareholders capital.

The senior-level managers at Company ABC are preparing their cash flow statement to understand which business activities bring positive and negative cash flows. IAS 7 Statement of Cash Flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Cash flow from investing activities - the amount of cash generated from investing activities such as purchasing physical assets investments in securities or the sale of securities or assets.

Statement of cash flows reports only those operating investing and financing activities that affect cash or cash equivalents. Cash Flow from Financing Activities is the net amount of funding a company generates in a given time period. Cash flow from financing CFF activities is a category in a companys cash flow statement that accounts for external activities that allow a firm to raise.

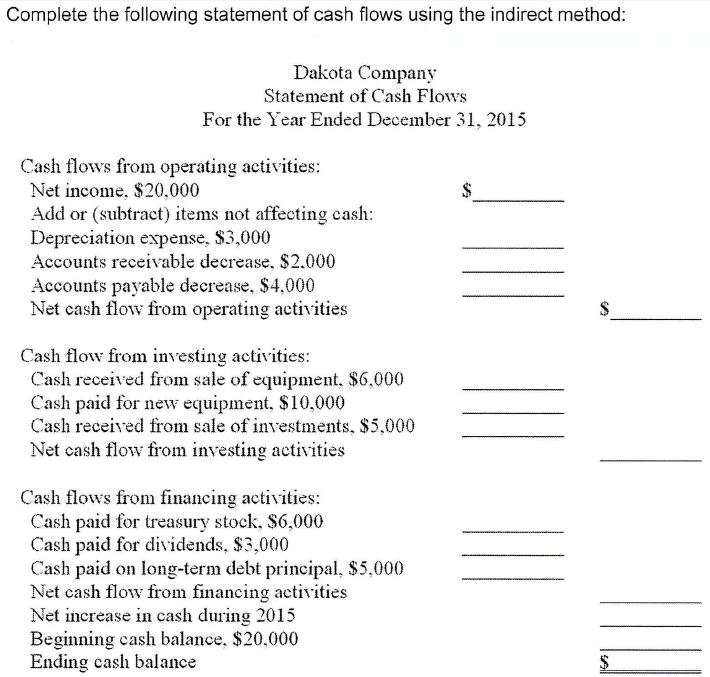

Figure 122 Examples of Cash Flow Activity by Category presents a more comprehensive list of examples of items typically included in operating investing and financing sections of the statement of cash flows. Cash flow from financing activities. In Example Corporation the net increase in cash during the year is 92000 which is the sum of 262000 260000 90000.

Types of Financial Models Types of Financial Models The most common types of financial models include. Cash Flow From Financing Activities. Changes in Cash Flow from investing activities.

The cash flow from financing activities are the funds that the business took in or paid to finance its activities. Therefore money is not equal to net income whereas on the income statement and balance sheet it should be equal including cash sales and sales made on credit. Figure 121 Examples of Cash Flows from Operating Investing and Financing Activities shows examples of cash flow activities that generate cash or require cash outflows within a period.

3 statement model DCF model MA model LBO model budget model. Of cash flow statement is to provide useful information about cash flows inflows and outflows of an enterprise during a particular period under various heads ie operating activities investing activities and financing activities. When a company borrows money for the short-term or long-term and when a corporation issues bonds or shares of its common or preferred stock and receives cash the proceeds will be reported as positive amounts in the cash flows from financing activities section of the SCF.

They include all other transactions not defined as noncapital financing capital and related financing or investing activities. Cash proceeds from the issue of shares or other similar instruments. A cash flow statement displays operating investing and financing activities in three separate sections reporting the cumulative total at the end.

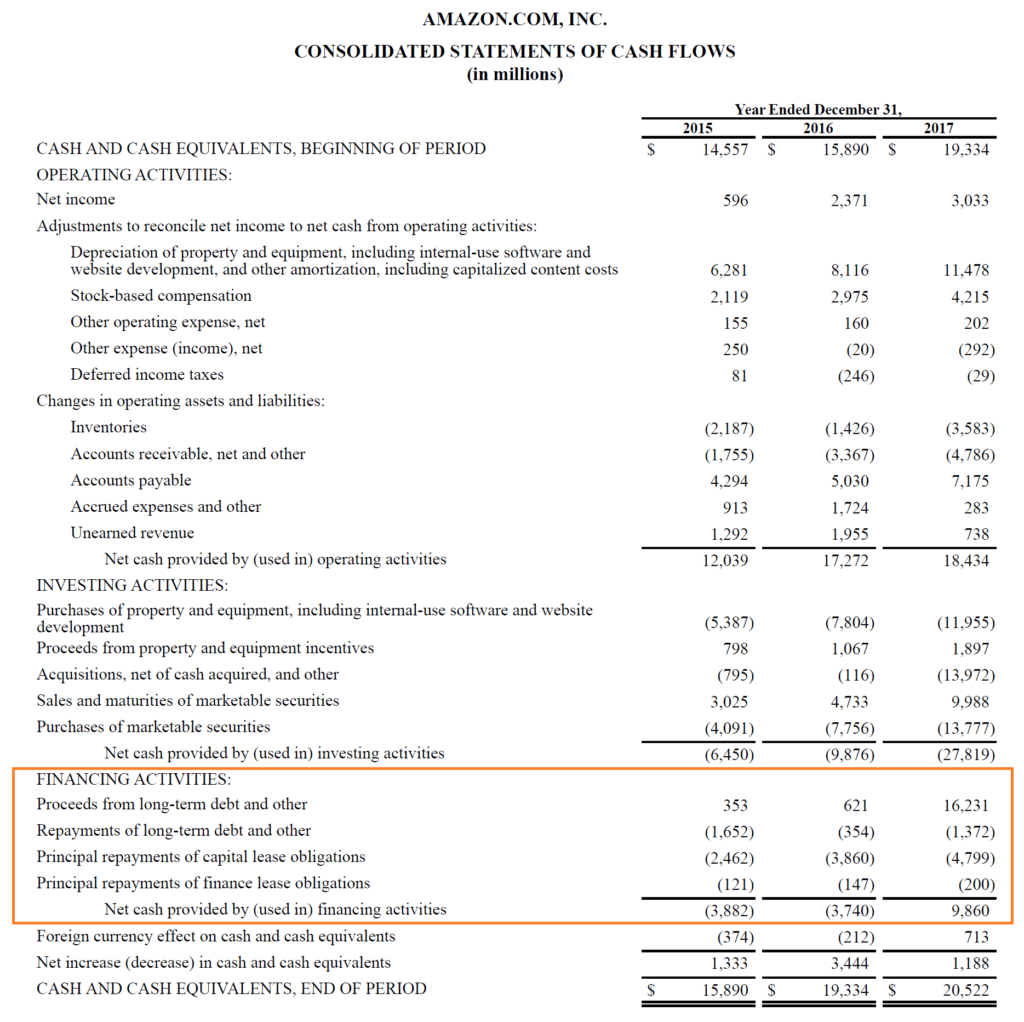

Cash Flow from Financing Activities Amazons Cash Flow from Financing activities comes from cash outflows resulting from the Principal repayment of long-term debt and obligations related to capital and financial leases. Cash flow from financing activities The cash flow statement is different from the balance sheet and income statement because it does not include the future transaction of cash listed on credit. Here the creditors mean the creditors for non-trading liabilities such as.

Amazons cash flow from Financing Activities was -291 billion in 2016 and. They have compiled the following data and want to determine how to work out net cash flow from operating activities investing activities and financing activities. The cash flow statement consists of three main sections.

Finally check about changes in financing activities and find out changes in Cash Flow from it like Equity capital Pref. Cash Outflow from Financing. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back.

When dividends are paid or debt is reduced cash out. Cash flow from financing activities is one of the three categories of cash flow statements. What this article covers.

A positive amount informs the reader. However some non-cash investing and financing activities may be much important for the users of financial statements because they may have a significant impact on the current and future performance in terms of revenues profits and the. Cash received from issuing of debentures loans and other borrowings.

Operating activities investing activities and financing activities. Cash flow from financing activities CFF - the net flows of cash that are used to fund the company. Bottom Line The bottom line on the Cash Flow Statement is the Net Increase Decrease in.

It usually involves flow of cash between company and its sources of finance ie owners and creditors. Financing activities section is the third and the last section of the statement of cash flows that reports cash flows resulting from financing activities of the business. Cash flow arising from Financing activities typically are.

The operating activities section is in a sense a catch-all category. Cash Flow from Financing activity Cash Received from Issuing shares or debts Cash Paid as Dividends and Reacquiring of shares or debts. Cap Debenture Bank Loan Dividend and Interest paid etc.

The three net cash amounts from the operating investing and financing activities are combined into the amount often described as net increase or decrease in cash during the year.

Three Types Of Cash Flow Activities

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Investing Activities Financial Edge

Cash Flows From Financing Activities Youtube

Cash Flow From Investing Activities Double Entry Bookkeeping

Cash Flow From Financing Activities Cff Formula

Noncash Investing And Financing Activities Direct Approach To The Statement Of Cash Flows Methods To Prepare A Statement Of Cash Flows Operating Activities Using Accounting Information

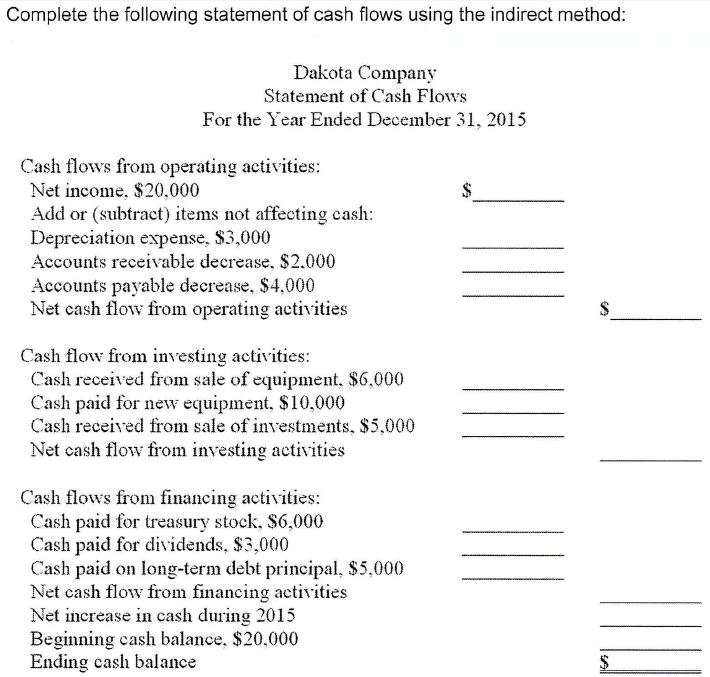

Solved Complete The Following Statement Of Cash Flows Using Chegg Com

0 Response to "Cash Flow From Financing Activities"

Post a Comment